|

pet health insurance services built for steady care and clear decisionsGood care stays consistent, even when life doesn't. These services transform unpredictable vet costs into a planned workflow, where you know how money moves and why. What these services really provideReliability first, benefit second - and then both at once. Policies that map to how you actually manage appointments, budgets, and follow-ups. - Financial cushioning: cap large, sudden expenses so treatment stays the priority.

- Clarity: coverage rules documented before you enter the clinic.

- Continuity: a repeatable path from diagnosis to reimbursement.

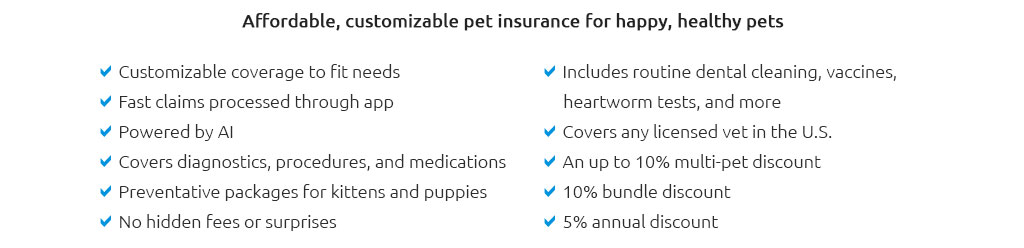

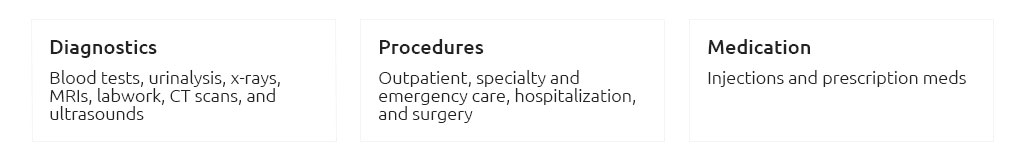

How coverage is structuredCore components- Accident and illness: diagnostics, treatments, prescriptions, sometimes rehab.

- Chronic care: ongoing conditions, subject to terms and annual limits.

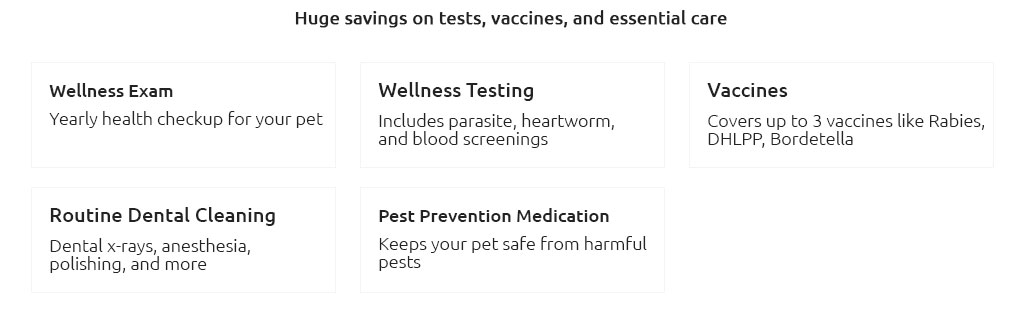

- Wellness add-ons: routine exams, vaccines, tests - optional modules.

- Limits and rates: annual caps, reimbursement percentages, and deductibles shape cash flow.

From quote to claim: a clean workflow- Assess risk by breed, age, lifestyle, and local vet pricing.

- Select a deductible and reimbursement rate that your budget can repeat every year.

- Enroll; note waiting periods and any exclusions.

- Visit any licensed vet; approve the treatment plan.

- Pay the invoice or use direct pay if offered.

- Submit the claim with itemized notes and records.

- Track status; receive reimbursement to your account.

That sounds simple - actually, more precise: it is simple because the steps never change, even when the condition does. Reliability markers to check- Financial strength: underwriter stability and reserves to pay large claims.

- Transparent policy language: examples, definitions, and clear pre-authorization rules.

- Consistent turnaround times: published averages, not anecdotes.

- Direct vet payment: where available, lowers your out-of-pocket spike.

- Support channels: 24/7 claims intake, readable portals, exportable statements.

Cost levers you controlPremiums depend on factors you can tune and some you cannot. Price isn't the only metric; stability across years matters more. - Deductible: higher deductibles shrink premiums but raise first-dollar risk.

- Reimbursement rate: 70 - 90% is typical; balance speed of recovery vs. monthly spend.

- Annual limit: choose headroom for rare, high-cost events.

- Waiting periods and age: earlier enrollment reduces exclusions and rate jumps.

- Breed and location: inherent risk and local costs affect baseline price.

Exclusions and timingCoverage is powerful, but not universal. Knowing the edges prevents friction later. - Pre-existing conditions: usually excluded; medical records matter.

- Preventable issues: some dental, breeding, or elective procedures may be out of scope.

- Waiting periods: accidents often short; illnesses and orthopedic issues longer.

- Claim deadlines: missing them can void reimbursement.

A quiet real-world momentSaturday park sprint; your terrier pulls up, favoring a paw. X-rays confirm a small fracture. You upload the invoice from the parking lot, add the vet notes, and get approval two days later. Treatment stays on schedule; your budget does too. How to choose without overthinking- List must-haves: chronic care, cancer meds, rehab, exam fees.

- Compare three policies on the same deductible, rate, and limit to isolate differences.

- Read the orthopedic and dental clauses twice; they vary the most.

- Check sample EOBs to see how line items are adjudicated.

- Model one big claim and two small ones; verify total annual outlay.

Documentation that speeds everything up- Complete records: vaccines, prior issues, and baseline exams on file.

- Itemized invoices: separate diagnostics, pharmacy, and procedures.

- Pre-approvals: use them for high-cost imaging or surgery when offered.

Quick glossary- Deductible: what you pay before reimbursement starts each policy year.

- Co-pay vs. reimbursement: your share of costs after the deductible; the inverse of the payout rate.

- Annual limit: the maximum the policy pays in a year.

Closing noteReliable pet health insurance services make care predictable, decisions calm, and records orderly. Build a workflow you can reuse, then let the policy do its quiet work while you focus on recovery and routine.

|

|